Dale Hammernik’s 3 Steps To Thinking Bigger on Pricing

Despite the stock market increases, and the national economic figures from the government bureaus showing a recovery, it’s not always felt on Main Street, here in Waukesha County.

And I can guarantee that your competitors (and many Waukesha County small businesses) are stressing and fretting over how to *survive*, these days — let alone thrive. For many, this is a mindset issue, and it’s something I like to advise my business owner clients about.

Because often, when we get trapped in this cycle of stress and fret, we lose the vision and the ability to think bigger.

But your competitors may not have someone like me in their corner! That means they’re probably committing some serious mistakes … and, that can be a GOOD thing for you.

As your advisor, I’d like to see you avoid their fate.

Follow my advice this week. It’s your livelihood at stake here.

Dale Hammernik’s 3 Steps To

Thinking Bigger on Pricing

“You have to see opportunity before you can seize it.” -Greg Hickman

It’s heartbreaking to watch so many Waukesha County small businesses go out of business or not bring home enough bacon simply because they get trapped into thinking about their pricing the wrong way.

When you differentiate yourself based on pricing, you simply cannot provide value. You end up competing on the wrong basis.

While price competitors have been in operation since the beginning of time, it’s important to understand that if YOU want to build a sustainable, scalable, and one day SALE-able business, a core foundational piece of that puzzle is that you must be charging enough for your services.

Is that possible in this economy? Absolutely.

Let me shift your thinking outside your particular world and into the retail world for a moment (though some of my readers are already living there). Stores that offer super-low prices like Wal-Mart and Target are thriving in this economy. So with that logic, you’d expect high-end stores like Nordstrom or Saks 5th Avenue to be out of business right now … but they’re not.

The super-high-priced Apple Watch is on everyone’s list. Luxury carmakers like Mercedes and BMW are reporting record sales despite the fact that “no one has money to spend.”

How can this be?

It’s simple, really. People DO have money to spend … if you’re not bringing it in, you’re simply not doing a good enough job showing them that your place of business is the best place to spend it.

You see, it’s all about the value. Could it be that you’re not communicating yours properly?

So how can you do this? Here are some things you can do right now:

1. Stop Acting Like a Commodity.

Your prospects have no way to know if you are the best option for them. To regular folks, most options are the same–in almost every industry. So when you compete on price, you’ll get price shoppers galore, who see you as just like everyone else. But, you are *not* like all the other options … are you?

So, what makes you different? And how do you show that to the marketplace? That’s what you need to focus on and show the world. Your prospects must turn to you because they trust you, and because they see your business as worth the money–not because you’re the cheapest option.

2. Identify the Value of the Outcome You Provide.

Why can Nordstrom’s charge higher prices for products found elsewhere (i.e. cars, purses, ties, shoes)? It’s because of the VALUE they’ve attached to their brand (i.e. social prestige, enhanced customer service, increased self-esteem). They’ve moved themselves out of the commodity market and into the heart, emotion and primal urges of their clients.

You need to do the same thing in your business. Yes, Mr. Customer can get a widget or receive a service for $XYZ … but what are they NOT getting when they work with that other option? Focus on these aspects. It’s not about the “feature” of your product or service … it’s about the intangible benefits from working with YOU.

3. Move Beyond “Typical” Pricing Strategies.

For service professionals,

there are only so many hours in a day, and you’ll reach an income plateau very quickly when you are billing by the hour. Not to mention that you have to start every month over at zero — and there’s no stability in that.

So, my advice? Consider billing on a flat-fee/value basis.

If you’re scared to shift, just think of the VALUE your customers will experience having a professional using flat-fee billing. They won’t be nickel-and-dimed for every phone call, email and fax that comes through the office. They can communicate with you as they wish without fear, and they can pick their price point of choice if you have multiple flat-fee options. And believe me, people are willing to pay more for certainty every time. It’s a win-win for them — and it’s very much a win-win for the health/sustainability of your business.

For retailers or product providers, you can only play “margin games” for so long. So, identify *monthly* services which might augment the experience of using your products. Consider what your customers WANT, and the problems they face in using your services. Restaurants could initiate a “VIP club”, with special perks, automatic billing and exclusive choices. Merchants can create enthusiast groups, or lessons and coaching.

The point is to go *beyond* the widget … into the heart of your customers’ desires.

Remember this: People still have money to spend … in every economy. And they NEED your products or services (right?). It’s up to you to convey the intrinsic value of working with you (even at a higher price point) to command the income level you want (and rightfully deserve) this year.

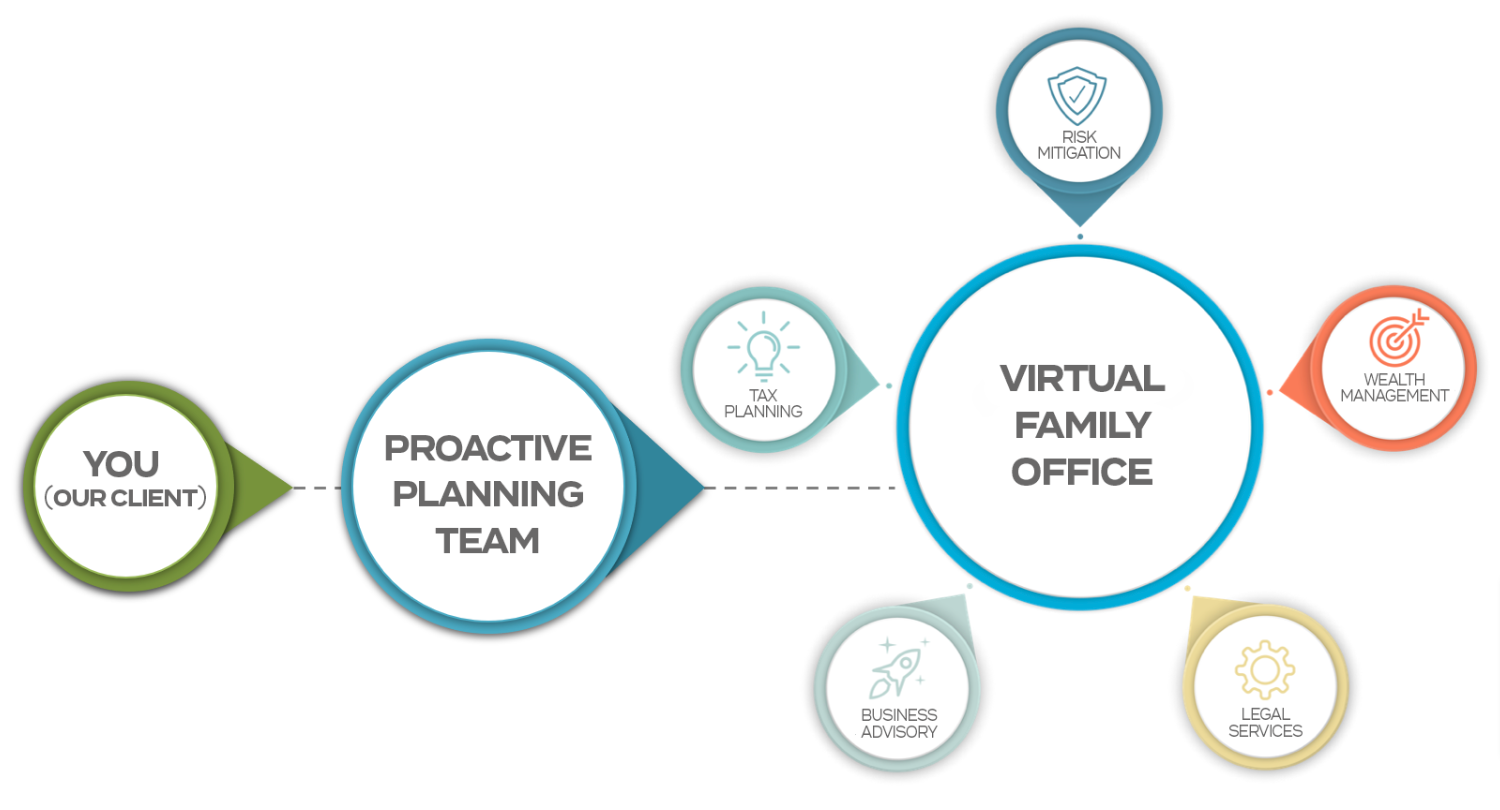

Feel very free share this article with a Waukesha County business associate or client you know who could benefit from our assistance — or simply send them our way? While these particular articles usually relate to business strategy, as you know, we specialize in tax preparation and planning for Waukesha County families and business owners. And we always make room for referrals from trusted sources like you.

Warmly (and until next week),

Dale Hammernik

(414) 545-1890

Hammernik & Associates

The post Dale Hammernik’s 3 Steps To Thinking Bigger on Pricing appeared first on Talking Tax to Milwaukee.

See More Blog Posts