The Myths About S Corporations—and Why They’re Commonly Misused

For many business owners, choosing the right entity type is one of the most important financial decisions they’ll ever make. Among the most

popular choices is the S Corporation (S Corp). While this structure can offer significant tax advantages in the right circumstances, it’s also one of the most misunderstood and misused business entities.

Below, we’ll break down the most common myths about S Corporations—and explain why so many owners run into trouble when they don’t fully understand how the rules really work.

Myth #1: An S Corporation Is a Type of Business Entity

The Truth: An S Corporation isn’t actually a type of business entity—it’s a

tax election.

You don’t “form” an S Corporation; you first create a corporation or limited liability company (LLC) and then elect S Corporation tax treatment with the IRS. Many owners assume the S Corp is a completely separate structure, but it’s simply a way of telling the IRS how you want your profits, losses, and distributions to be taxed.

Myth #2: S Corporations Eliminate Self-Employment Taxes

The Truth: S Corps can reduce self-employment taxes, but they don’t make them disappear.

One of the biggest selling points people hear is that S Corps “save you thousands in taxes” because you avoid self-employment tax. But here’s the catch: the IRS requires that S Corporation owners pay themselves a reasonable salary. That salary is subject to payroll taxes (Social Security and Medicare), just like any other employee. Only the profit distributions above that salary are exempt from self-employment tax.

If you pay yourself too little, the IRS can reclassify your distributions as wages and hit you with penalties.

Myth #3: Everyone Should Be an S Corporation

The Truth: S Corps are not always the best fit.

For small businesses just starting out or those with modest profits, the additional payroll filings, state requirements, and accounting complexities may outweigh the tax benefits. In some cases, an LLC taxed as a sole proprietorship—or even a C Corporation—may be the better option depending on your long-term goals, reinvestment strategy, or desire for outside investors.

Myth #4: S Corporations Save You Money Automatically

The Truth: S Corps only save money if they’re

structured and maintained correctly.

Yes, you can save on self-employment taxes by splitting income between salary and distributions. But if your books aren’t clean, payroll isn’t processed properly, or distributions are handled incorrectly, those “savings” can evaporate into penalties, audits, and unnecessary stress.

Myth #5: You Don’t Need Help Managing an S Corporation

The Truth: S Corps require ongoing compliance and proactive tax planning.

An S Corp isn’t a “set it and forget it” election. Owners must manage reasonable compensation, payroll tax filings, shareholder basis tracking, state-level requirements, and annual elections. Without guidance from a knowledgeable accountant and tax planner, many owners misuse the structure—leaving money on the table or creating IRS red flags.

Why S Corporations Are Commonly Misused

- Misinformation from peers or online sources – Many owners hear about S Corps from friends, family, or internet forums without understanding the full picture. "S Corporation" has become an internet buzz word that influences many business owners to assume they should be structured as one, without analyzing their personal situation.

- DIY entity setup – Filing the election without professional guidance often leads to mistakes in payroll, distributions, and recordkeeping.

- Lack of proactive planning – Owners make the election but never revisit whether it’s still the right choice as the business grows.

- Focus on short-term tax savings – Without considering long-term goals like retirement planning, exit strategy, or bringing on partners, the S Corp can create limitations.

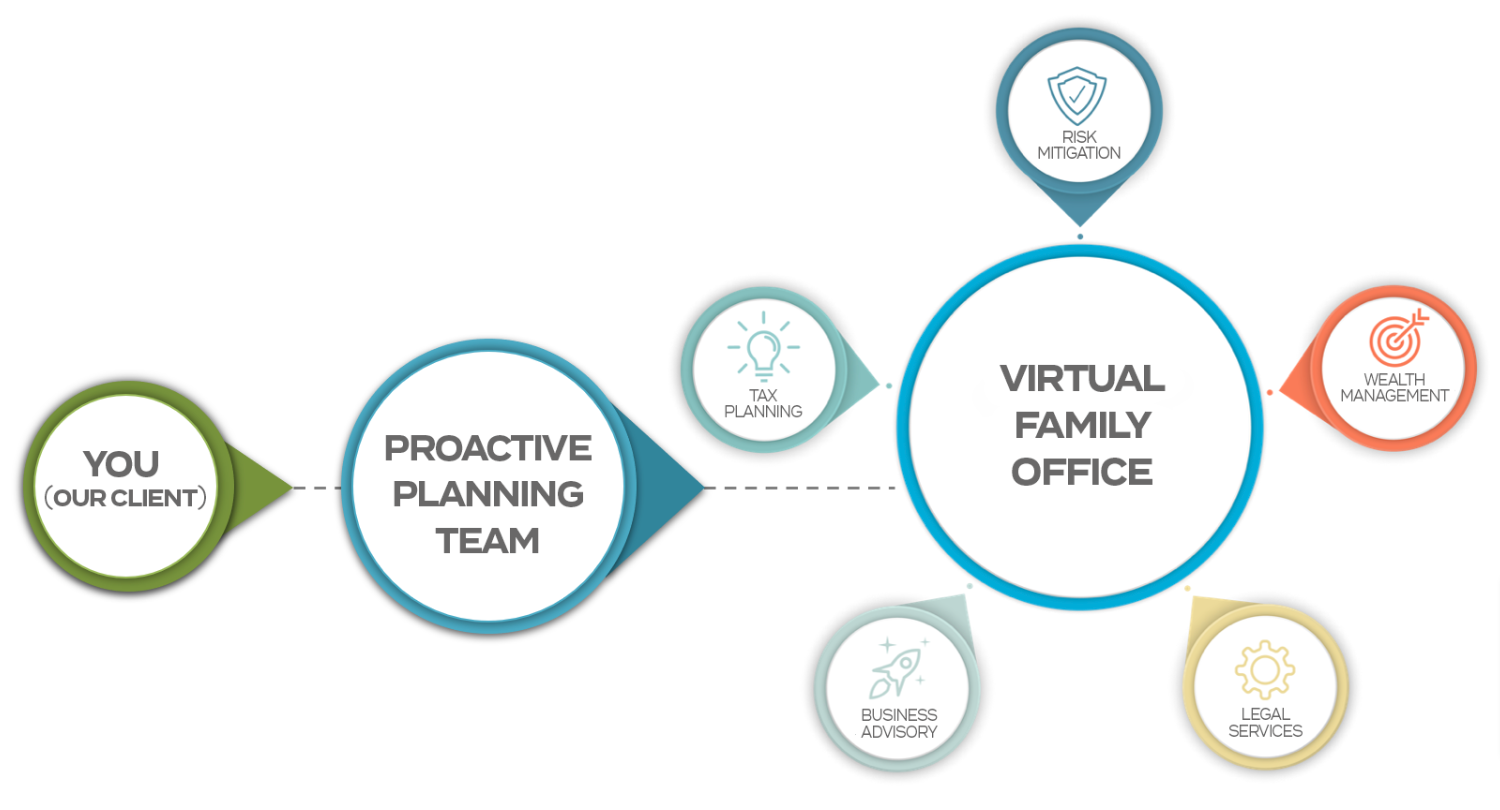

How Hammernik & Associates Helps

At Hammernik & Associates, we know entity choice is not a “one-time decision.” Business goals, income levels, and tax laws change over time—which is why we analyze entity optimization for our clients on an annual basis.

Our team reviews whether your current structure—S Corporation or otherwise—is still the best fit to minimize taxes, reduce risk, and support your long-term strategy. Sometimes, that means staying the course. Other times, it means adjusting salary levels, refining payroll, or even considering a different entity election.

This proactive review helps our clients avoid the common pitfalls of S Corps while ensuring they’re always taking advantage of the best structure for their situation.

The Bottom Line

S Corporations can be a powerful tax-saving tool—but only when used in the right situation and managed correctly. Too often, business owners are sold on the myth of “automatic tax savings” without being told about the responsibilities and pitfalls.

If you’re considering an S Corporation election—or if you already have one and aren’t sure if you’re using it correctly—it’s wise to sit down with a tax advisor who can help you evaluate whether this structure truly fits your business goals.

See More Blog Posts