Dale Hammernik Reveals 3 Significant Marketing Mistakes (Part 3 of 3)

An honest question for you: how’s business, as we wrap up the summer?

Is there anything I can do to help you this week? I obviously take pleasure in helping my clients and business owner friends thrive during this craziness in our culture and economy, and my weekly Notes are just one way I’m happy to help.

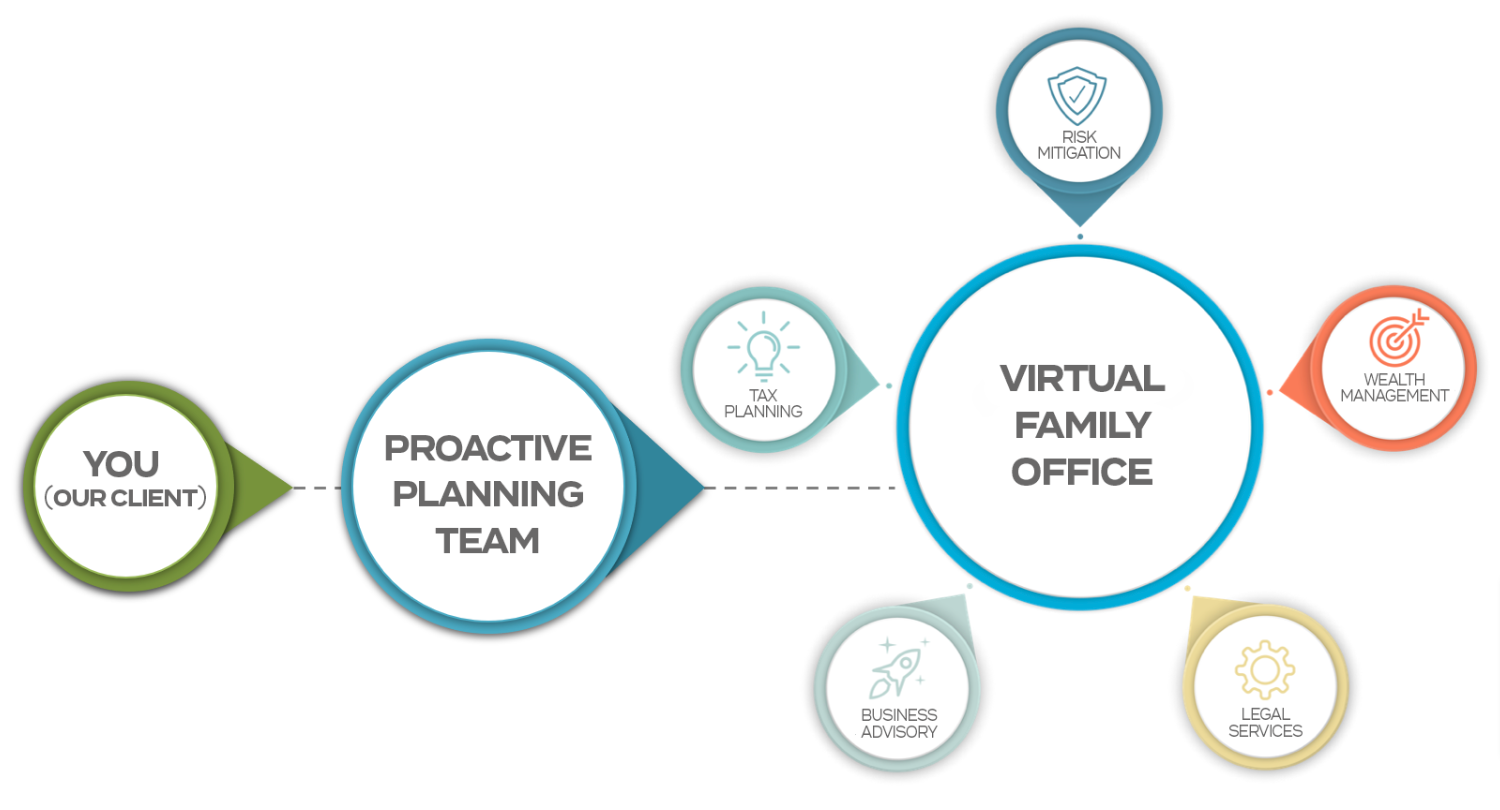

But I hope you know that there’s probably other ways in which we could come alongside you and your business. From cash control analysis, to taking financial tracking off your plate, to tax planning and other consultations — Hammernik & Associates is here for you.

Give me a call ((414) 545-1890), or send me an email … we are in your corner.

So, in this week’s Strategy Note, I’m wrapping up my three-part series on sales and advertising blunders to avoid. From the many notes I’ve received, I know this has been useful. I’m truly glad to be of service.

Read on, and send me your feedback.

Dale Hammernik Reveals

3 Significant Marketing Mistakes (Part 3 of 3)

“One thing is sure. We have to do something. We have to do the best we know how at the moment… If it doesn’t turn out right, we can modify it as we go along.” -Franklin D. Roosevelt

The last two weeks, I’ve written about how many small businesses in the Waukesha County area shoot themselves in the foot by failing to improve their advertising and sales processes. So far, I’ve given you FIVE blunders to avoid:

1. Failure to tell your story.

2. Right product, wrong market?

3. Right market, wrong problem?

4. Right problem, wrong pitch or promise?

5. Right pitch, wrong timing?

So, let’s keep plugging those holes for you, shall we? Here’s the final installment.

6. No urgency.

In most cases, of course, it’s just common courtesy not to rush people. But that’s a courtesy you can’t afford when you’re trying to close a sale. Why? Because of the salesperson and marketer’s greatest enemy… inertia.

If you can’t give your prospect a push to “act now,” you’re only inviting him to shelve the offer until later. Translation: never. It’s not a question of politeness, it’s a question of sales and marketing survival.

Go back and look more closely at your sales piece or script. Start with the offer and work backward. Is there a deadline for any special deal you’re offering? Is there a bonus for a speedy reply?

If you can work it into the deal, do so. But then move back through your piece and find places you can repeat or highlight the deadline date. Make it as specific as possible. Midnight on a certain date, just weeks from your mailing. Or maybe a website countdown. Or limited number of orders allowed.

If there’s one thing that drives people more than the promise of getting something, it’s the fear of missing out. In short, if there’s no urgency, find some. And make sure you build that tension, the closer you take your prospect to the point of the sale itself.

7. Failure to offer proof

As much as we may consider ourselves thoroughly rational creatures (and I say this as a “numbers person”!), no sale is ever made based on logic alone. The way to get attention and action is with emotion.

(Some people shy away from using emotion, and that’s quite understandable – because it’s often perceived as “manipulative”. My simple contention here is that if we don’t speak in the language of emotion, then we’re not truly speaking the real language of life.)

That said, once you’ve engaged a prospect emotionally, you’ve got to give him or her a reason to believe. You’ll want to work into your script or sales piece a way for your prospective client to go back and rationalize the smart decision they made to use your product or service.

Credibility-building charts and statistics, relevant stories, strong testimonials, track record, expert testimony, reassuring credentials … they all add up to support the prospect’s original emotional commitment.

If you are already using these elements, I suggest you go back and make sure your proofs are clear and easy to read. If you’ve got testimonials, make sure they’re as naturally presented as possible. Don’t use stock photos. Use pictures of the real customer. If you can use full names, do. If you’ve got experts who recommend your product, mention them.

If you’re reading third-party sources that support your claims, name them. And use quotes just long enough to show that the credible experts agree. Don’t just say your results are great. Show what happens when you get great results. Thinner customers. A nicer car. A bank statement. A healthy, happy couple. And so on.

Anything to put an image into the imaginations of your future customers.

8. Failure to close

This is the last one, and it’s a biggie.

Zig Ziglar famously said, “Timid salespeople have skinny kids.” And once you’ve gone through your sales process, written a fantastic sales piece or advertisement, you MUST seal the deal with an actual “ask” and a clear call to action–stating *exactly* what your prospective customer should do right now.

Without this final step, all your good efforts go to waste!

Again, I don’t pretend to be a “guru” … I just see what works, and I pass it on.

Feel very free forward this article to a Waukesha County business associate or client you know who could benefit from our assistance — or simply send them our way? While these particular articles usually relate to business strategy, as you know, at Hammernik & Associates we specialize in tax preparation and planning for Waukesha County families and business owners. And we always make room for referrals from trusted sources like you.

Warmly (and until next week),

Dale Hammernik

(414) 545-1890

Hammernik & Associates

The post Dale Hammernik Reveals 3 Significant Marketing Mistakes (Part 3 of 3) appeared first on Talking Tax to Milwaukee.

See More Blog Posts