Dale Hammernik Reveals 3 Common Advertising Mistakes

With all of the chaos swirling around — Israel/Palestine, Russia/Ukraine, the border mess, EBOLA, etc. — it’s tempting to just throw your hands up and drown yourself in work … or drown yourself in the chaos, and rut there for a while.

So how are you feeling about your business this week ?

I’ve got some marketing and sales advice to lift your vision (very attainable, btw) and I wanted to offer you these important reminders, during a storm:

Hammernik’s Key Reminder #1: What you choose to “ingest” over these next few days will greatly impact your state-of-mind. Garbage in, garbage out, as they say. And, of course, the opposite is true — when you surround yourself with excellence and clear-eyed determination, you find that your heart and mind carry much greater strength.

Temper your media intake this week, as most of those outlets are (quite literally) merchants of fear.

Oh, and as I write this, it’s no surprise that the stock market is “reacting” a bit. (The Dow Jones is down about 500 points since Tuesday, 7/29.) So, this leads to my second reminder:

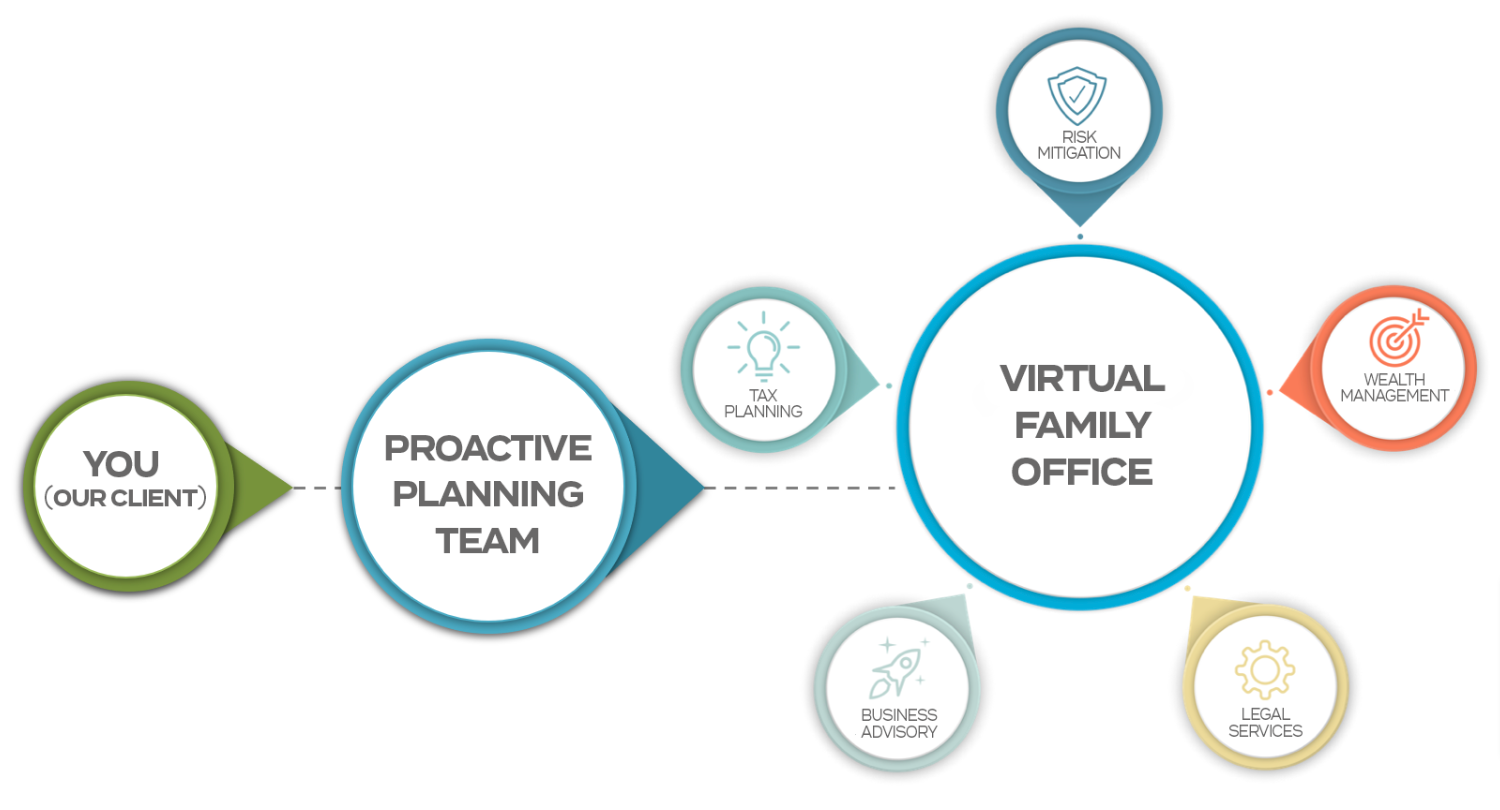

Hammernik’s Key Reminder #2: The only thing certain about the stock market is that it’s volatile. So those of you with many assets resting there, don’t make moves out of panic. Sit down to discuss a tax-advantaged strategy … not a knee-jerk fear response.

Hammernik’s Key Reminder #3: The only thing you can truly control is yourself. You can’t control the market, you can’t control our foreign affairs (unless, of course, Messrs. Kerry or Hagel are somehow reading this — perhaps you guys can!), and there’s a real sense in which you can’t even, really, control your salary and income.

And don’t believe that you can fully control your business, or your client behavior — that’s a clear path towards irrelevance and bankruptcy. But you CAN affect your business through effective sales and marketing.

But so much of what people do with their existing advertising doesn’t work. So I’ve put together some clear-eyed advice about what DOES work (and I’m speaking from personal experience here).

Oh, and if you’d really like to talk this week (and I don’t blame you) I have EIGHT open tax-planning sessions. But I urge you to move quickly, as they’re going quickly. Send me a quick email, or call: (414) 545-1890 to grab one.

On to making your advertising better…

Dale Hammernik Reveals

3 Common Advertising Mistakes

“The great accomplishments of man have resulted from the transmission of ideas of enthusiasm.” – Thomas J Watson

Whether you create most of your sales through referrals, through direct marketing, or with a dedicated sales force–there’s some common mistakes I’ve seen which are destined to suck the life out of your sales process.

Starting this week, I’ll be sharing a series of them so that you can FIX them, if you discover you’re making them. As we move through summer (a typically “slow” season for many businesses), it’s the perfect time to evaluate your marketing processes…and plug the holes.

So, here’s a start…

1. Failure To Tell Your Story

One of the simplest mistakes many marketers or sales professionals make happens long before they set out to make a sale: they don’t settle into the clear, *unique* story behind their service or product.

I’m not referring to an “origins” story (though that’s often pertinent), but rather–what’s the MAIN message nobody else is telling? Or just as good–what’s the story that sets you apart from your competitors?

This is often called the “Unique Selling Proposition” (USP), and it’s essentially: “Why you?”

Ask yourself…if you had five seconds to sum it all up, and you had to close the deal on the spot…what would you say?

When the answer to that little thought experiment is enough to complete a sale, you’re good.

2. Right Product, Wrong Market?

This one isn’t always something you can control, but every business owner should get feedback from their customers/clients about this.

Is your proposed customer base actually interested in the item or service you’re wanting to provide? You could be selling the best darn carpet cleaning service in Waukesha County…but what if everyone’s got hardwood floors?

So…before you launch that new service or product, do some *basic* research: Are there other businesses in the Waukesha County area successfully selling a similar product or service? Despite your fears–that’s a GOOD sign, because it means you won’t have to carve out some kind of unique niche.

It seems, though, that many business owners pursue the “holy grail” of a totally unique offering…and forgetting that it’s probably unique for a reason.

Similarly, many business owners come to the market with what THEY want to sell…and don’t give any serious thought or research into whether it’s something which folks want badly enough to fork over their wallets for it.

3. Right Market, Wrong Problem?

Let’s assume, at this step, you’ve got the right target market. And you’ve got enough of them in one place that you’ll be able to sell something effectively.

But still, the product or service fails. What happened?

The next thing you have to ask is if you’ve really got your finger on the DESIRES of your targets…not just their NEEDS.

Are you really speaking to the element they care about most? Or are you just pitching to the things you *think* the prospect should care about? Surprisingly, those two factors may not be the same thing.

If you think this might be a trouble spot, the next step is to go where those prospects congregate and listen. Ask questions. Take notes. What online forums do they read, and what do they write about within them? What other products do your prospects use, and in response to what sales pitches?

What grabs their attention in the headlines? What do they whisper about at cocktail parties and around the cooler? When they lie awake at night, what do they worry about?

Get the answers to THESE questions, and your sales pitch is practically written for you.

Again, I don’t pretend to be a “guru” … I just see what works, and I pass it on.

Feel very free forward this article to a Waukesha County business associate or client you know who could benefit from our assistance — or simply send them our way? While these particular articles usually relate to business strategy, as you know, at Hammernik & Associates we specialize in tax preparation and planning for Waukesha County families and business owners. And we always make room for referrals from trusted sources like you.

Warmly (and until next week),

Dale Hammernik

(414) 545-1890

Hammernik & Associates

The post Dale Hammernik Reveals 3 Common Advertising Mistakes appeared first on Talking Tax to Milwaukee.

See More Blog Posts