By Brad Tobin

•

September 23, 2025

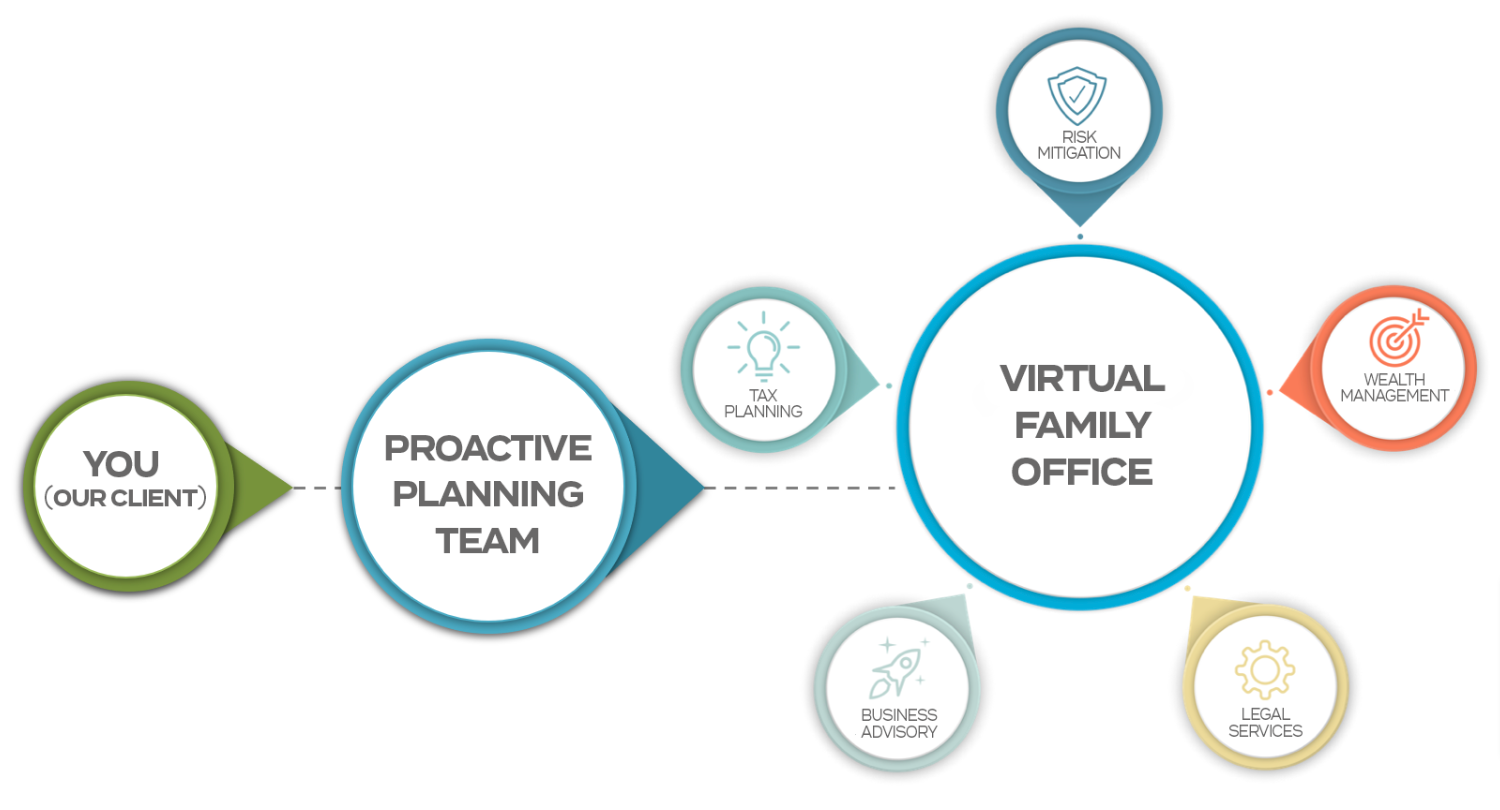

In July 2025, Congress passed and the President signed into law the One Big Beautiful Bill Act (OBBBA), bringing major changes to the U.S. tax code that significantly impact businesses, investors, pass-through entities, and estate planning. Many provisions build on the Tax Cuts and Jobs Act (TCJA). Some are permanent, others temporary, and all require careful planning to maximize opportunities and avoid pitfalls. If you are a business owner, investor, or considering succession or estate planning, these changes could affect you directly. Key Business & Investment Tax Changes QBI Deduction Made Permanent ● 20% deduction for pass-through entity income (LLCs, S-corps, partnerships, sole proprietorships) is now permanent. ● Income thresholds for specified service trades or businesses (SSTBs) increased for 2025 ($394,600 for joint filers and $197,300 for other taxpayers). ● Starting in 2026, phase-in ranges expand: $150k for joint filers and $75k for others. ● Taxpayers with at least $1,000 in QBI may claim a minimum $400 QBI deduction. 100% Bonus Depreciation Permanently Extended ● Businesses can fully deduct qualifying property (equipment, vehicles, and certain buildings) placed in service after Jan 19, 2025. ● Manufacturing buildings qualify if placed in service before Jan 1, 2031. Qualified Opportunity Zones (QOZs) ● Program is now permanent, with new 10-year designations beginning Jan 1, 2027. Estate, Gift, and Succession Planning ● Lifetime estate and gift tax exemption increased to ~$15 million per person (indexed for inflation beginning in 2026). ● Adjustments to Qualified Small Business Stock (QSBS) for shares issued after July 4, 2025. Tip Credit Expansion ● FICA tip credit extended to beauty service businesses. Other Key Provisions ● Restored Research and Development expensing (Section 174). ● Interest deduction changes (ATI excludes depreciation, amortization, or depletion). ● Higher Section 179 deduction and phase-out thresholds. ● Expanded Low Income Housing Tax Credit allocations. ● Clean Energy Tax Credit changes: Section 45L and 179D repealed after June 30, 2026. Considerations & Challenges ● Some provisions are temporary (e.g., certain deductions and caps), so timing is critical. ● Income phaseouts may limit benefits for high-income pass-through owners. ● Increased compliance complexity (e.g., amended returns, documentation) will be important. ● Real estate ownership structures and financing choices may need reevaluation in light of new depreciation and interest rules. Planning Opportunities for Businesses & Investors Accelerate Capital Expenditures Investing in equipment, vehicles, or eligible buildings now can provide immediate tax benefits through 100% bonus depreciation. Optimize Business Structure for QBI Assess ownership, entity type, and income levels to maximize the 20% deduction. Service businesses might gain advantages by restructuring to distinguish between qualifying and non-qualifying activities. Estate & Succession Planning Take advantage of the higher exemption to transfer assets via gifts or trusts while the thresholds are still beneficial. Consider Qualified Small Business Stock (QSBS) opportunities if you are investing in or selling small business shares. Leverage Tax Credits & Incentives Investigate possibilities in affordable housing and Qualified Opportunity Zones, but ensure compliance with updated documentation requirements. Cost Segregation for Real Estate Think about conducting cost segregation studies to enhance depreciation benefits on properties. Model Income Scenarios Create multi-year projections to optimize the timing of income, deductions, and asset acquisitions to avoid crossing phaseout thresholds. What’s Next? The One Big Beautiful Bill Act transforms the tax environment for businesses and investors alike. Featuring permanent QBI deductions, reinstated R&D expensing, and bonus depreciation, it unlocks extraordinary chances to minimize taxable income. Additionally, enhanced estate and gift exemptions offer robust strategies for effective succession planning. However, these advantages won’t maximize themselves. Considerations such as timing, entity structure, and integrated planning are crucial — as every choice can significantly alter your tax responsibilities. To understand how these developments affect your unique circumstances, reach out to us at Hammernik & Associates. Together, let’s devise a strategy that strategically positions your business for success in 2025 and beyond.