House Passes Tax Bill…What’s Next?

So, the House of Representatives passed their version of the tax bill yesterday. Does that mean everything in the bill is legal tax code now? What does that mean for your tax return? What is going on?!

As a young student, with the help of School House Rock, I learned how a bill becomes a law. The House approving the bill, is progress, but it is not finality. The progress of the bill turning into a law is now on the Senate. The Senate has their own version of the tax bill, that has many similarities, but has some twists to it. To make things even more complicated, the Chair of the Senate Committee of Finance, had the ability to “mark-up” the Senate bill. The Chairman’s Mark as it is called, gives him the ability to tweak the bill before putting it to a vote. The current chairman is Senator Orrin Hatch (R-Utah). I will try and break down the differences between the House version, the Senate version, and the Chairman’s Mark.

Tax rates

We currently have seven (7) tax brackets: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

- The House bill proposed four (4) tax rates: 12%, 25%, 35% and 39.6%.

- The Senate bill, as initially proposed, would keep seven (7) brackets and reduce the top marginal rate to 38.5%.

- Under the proposal as outlined in the Chairman’s Mark, the Senate would keep (7) rates as before but would lower the rates in the middle.

Child Tax Credit

The credit is currently $1,000 and is refundable.

- Under the House bill, the child tax credit would be increased to $1,600 per child under 17 – subject to phaseout – with an additional $300 credit for each parent as part of a consolidated family tax credit. The first $1,000 would be refundable.

- Under the Senate bill, the child tax credit would be bumped to $1,650, with a much higher phaseout for ($1 million for married couples filing jointly). As with the House bill, the first $1,000 would be refundable.

- Under the proposal as outlined in the Chairman’s Mark, the child tax credit would be increased to $2,000 and phaseouts would begin at $500,000 for married couples filing jointly.

Obamacare Health Mandate

- Under the original House and Senate proposals, the mandate would stay.

- Under the proposal as outlined in the Chairman’s Mark, the individual mandate penalty would be eliminated beginning in 2019.

Above The Line Deductions ( Before your Adjusted Gross Income)

Currently, you can claim certain above-the-line expenses (meaning that you can claim them even if you do not itemize).

- Under both proposals, most above-the-line deductions would be eliminated, including those for student loan interest, moving expenses and out of pocket expenses for teachers.

- Under the proposal as outlined in the Chairman’s Mark, the above-the-line expense limit for teachers would stay in effect but the limit would be increased to $500 (it’s currently $250).

Business Taxes

Businesses use structures like limited liability companies (LLCs) or S corporations to pass-through income to the owners, escaping tax at the company level: Income is taxed at individual rates.

- Under the House proposal, businesses conducted as sole proprietorships, partnerships, and S corporations would be taxed at a rate of 25%. Businesses that offer “professional services” like doctors, lawyers, accountants, designers, and consultants wouldn’t qualify for the reduced rate under the proposal. Other business owners can choose to categorize 70% of their income as wages (and pay the individual tax rate) and 30% as business income (taxable at 25%) OR set the ratio of their wage income to business income based on the level of their capital investment.

- Under the Senate proposal, pass through income would be allowed a 17.4% deduction. As with the House bill, certain professional services, are excluded from the tax break – except those individuals with income up to $75,000 ($150,000 for married taxpayers filing jointly).

- Under the proposal as outlined in the Chairman’s Mark, more businesses could claim the special 17.4% deduction. Certain professional service which were formerly excluded – like lawyers – would now be included so long as their income was no more than $500,000 for married taxpayers filing jointly and $250,000 for individuals. Additionally, the markup would limit the amount of the 17.4% deduction to 50% of the taxpayer’s W-2 wages (including wages subject to wage withholding, elective deferrals, and deferred compensation); the W-2 wage limit would not apply to taxpayers with taxable income of less than $500,000 for married taxpayers filing jointly or $250,000 for individuals (phase-ins apply).

Buh-Bye Free Meals

Say goodbye to those free lunches. Under the proposal as outlined in the Chairman’s Mark, employers would no longer be able to deduct expenses for meals provided for the convenience of the employer on the employer’s business premises.

New Tax Form….More forms??!!

Simple, right? They are going to let me file my taxes on a postcard? NOPE. Under the proposal as outlined in the Chairman’s Mark, not only are tax forms not shrinking much, there would be a new tax form. The federal form 1040SR (as in senior citizen, so creativ) would be for use by persons who are age 65 or older by the end of the taxable year and would be “as similar as possible to the Form 1040EZ.” The difference is that the use of form 1040SR would not be limited by taxable income or by certain income types.

IRS Funding

You’re thinking more budget cuts, right? Despite the fact that the IRS has experienced significant cuts since 2010, the Senate doesn’t wish to continue down that path, saying, as part of the Chairman’s Mark: The proposal expresses the sense of the Senate that politically motivated budget cuts are counterproductive to deficit reduction, diminish the IRS’s ability to adequately serve taxpayers and protect taxpayer information, and reduce the IRS’s ability to enforce the law.

The Chairman wants to keep up with the uprising in identity theft, and also wants to make sure the IRS is capable of going and getting tax money that is theirs through audits.

Note: Earlier this year, President Trump suggested dropping the Internal Revenue Service (IRS) budget by $239 million.

Expiration Dates

You didn’t really think this was going to be permanent, right? As with the Bush tax cuts of 2000, not all of the proposed changes will be permanent. In this case, all individual income tax changes, except the elimination of the individual mandate penalty, would expire at the end of 2025. This includes the individual income tax rate cuts, the increased standard deduction, and the expanded child tax credit.

HOWEVAAAA…. Those corporate tax rates? They would be permanent…for now.

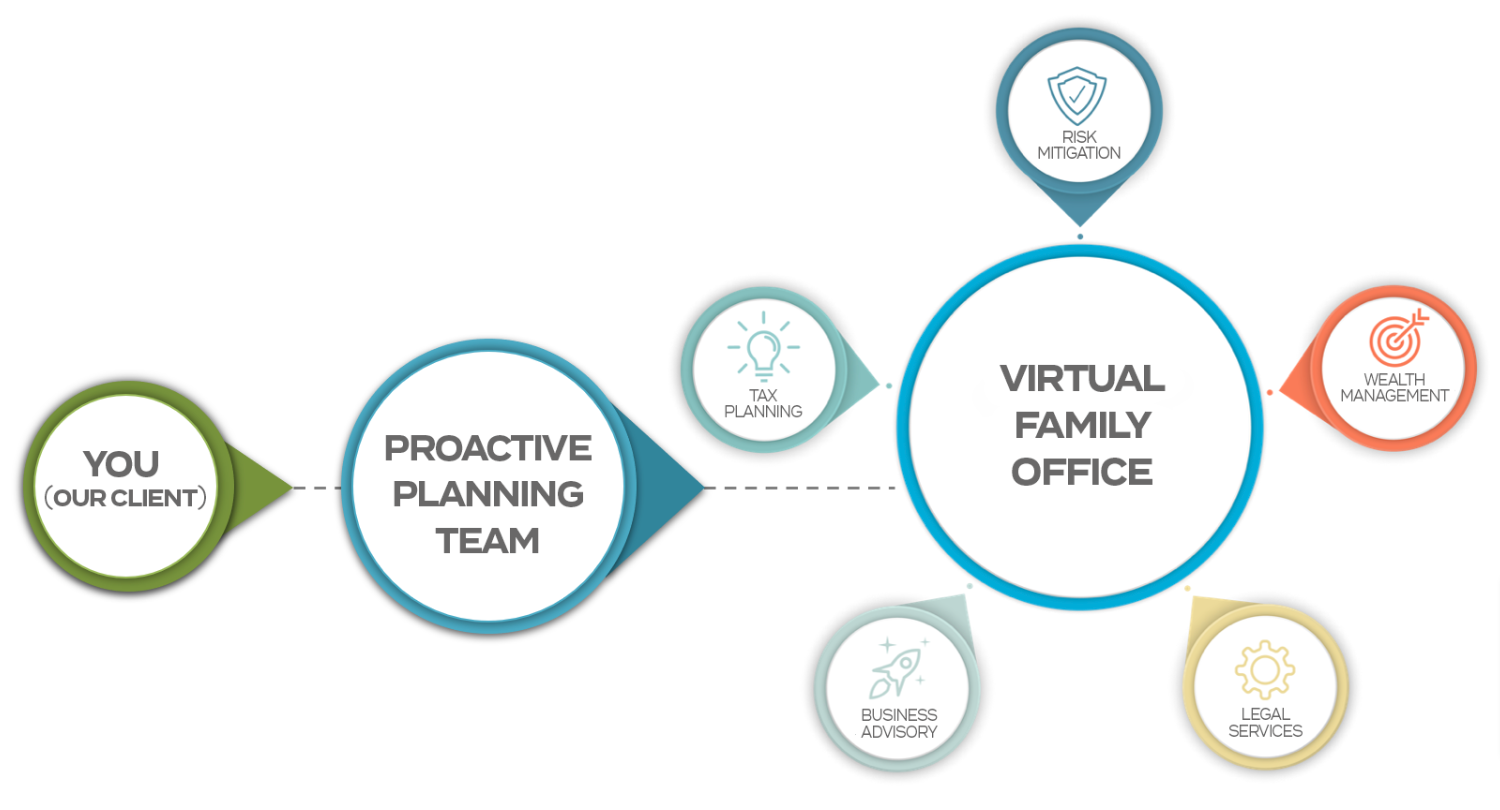

The Senate needs 50 votes to pass the bill. The GOP may need some help from Democrats on this as the majority in the Senate is not as overwhelming as it is in the House. IF…a big if…the Senate passes their version of the bill, the House and the Senate will then get together to reconcile the differences in each bill to come up with a final bill to present to the President. The House voting to approve their bill is a step towards a change in the tax law, but their are still some obstacles to get through for that to pass. We will keep you up to date with all the happenings with the tax bill, and are ready to assist you in tax planning to prepare for any changes that will affect your individual situation. If you have any questions about any parts of the tax bill proposals, please feel free to contact me at nhammernik@hammernikassoc.com.

Onward,

Nicholas Hammernik, EA

Hammernik & Associates provides tax services in West Allis, WI to the taxpayers of Southeastern Wisconsin and beyond. Keep up to date with all happenings in the tax world by following our blog, subscribing to our newsletters, and following us on Facebook.

The post House Passes Tax Bill…What’s Next? appeared first on Talking Tax to Milwaukee.

See More Blog Posts