Twitter Tax Search

I was struggling to decide a topic to blog about this week, so I took to Twitter to help me out. After all, Twitter is the best way to see what everyone is currently talking about in the world. You can follow us on Twitter at @HammernikTax. I did a simple search for the word “tax” on Twitter. Here are the main topics currently being discussed involving the word tax.

Donald Trump’s Tax Return

This is not a political blog, so I will not be discussing politics, however, this is relevant to our industry. The main topic of discussion revolves around Donald Trump not yet releasing his tax return. It seems like everywhere you go, your tax return is wanted to evaluate your current financial situation. Examples of this include: buying a car, buying a house…and running for president.

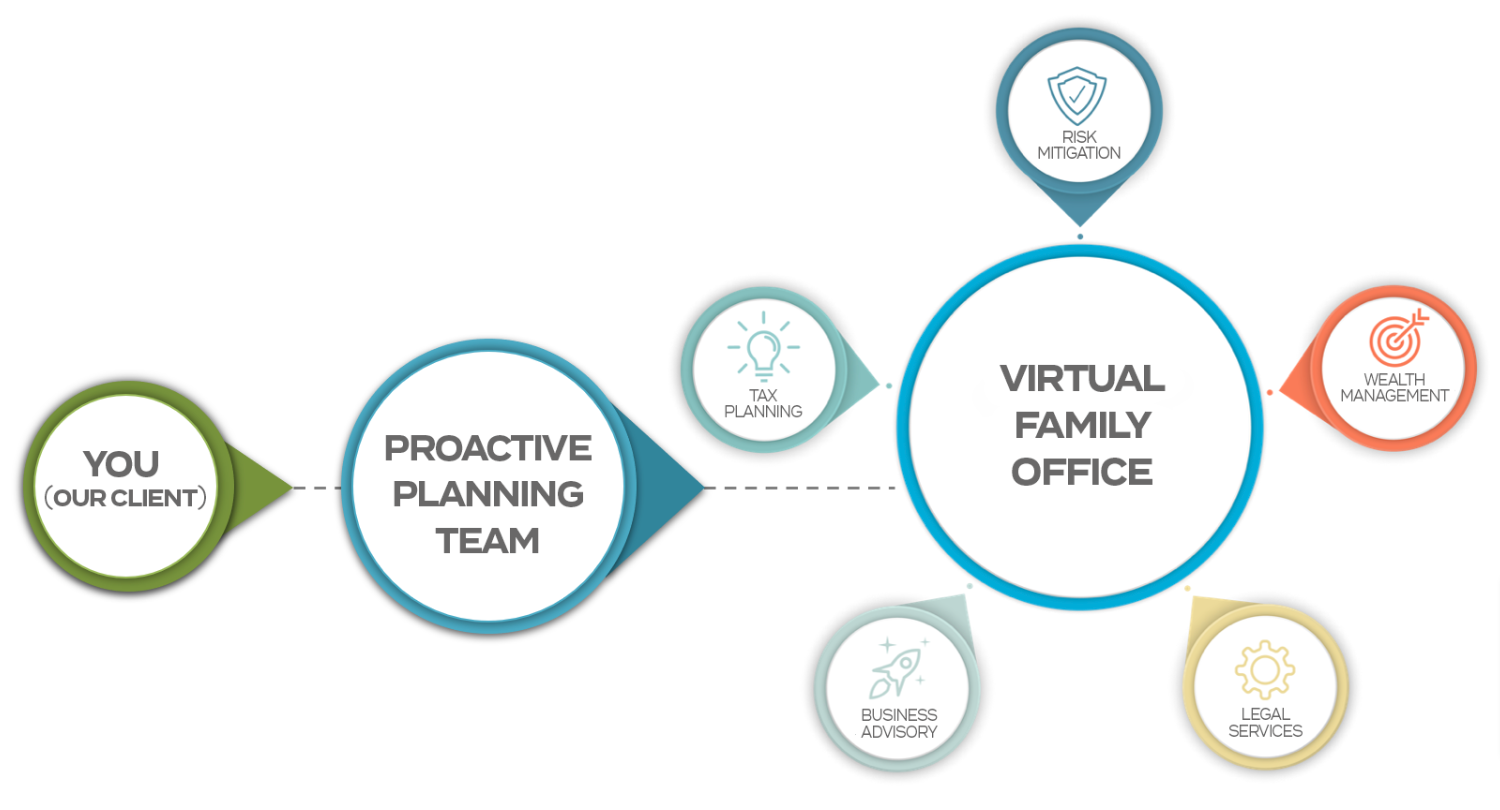

However, a tax return may not always tell the whole story. Our job as tax consultants is to devise strategic plans for our clients to reduce the amount of income they are showing on their tax returns. For instance, we may suggest a client defers more money to their 401K to reduce their taxable income. The tax return will now show that they are making less money, when in reality, they are making the same amount but are “hiding” some of it. So while it seems that we are often judged on the numbers on our tax returns, the tax return is just a sneak peek into the whole story. On that note, you have a little over 3 months left to do your own tax planning to create your own story. That is where the strategic plans on our part come into play. If you think you need to move some things around before the year is over, contact our office ASAP.

Are Contributions To Political Campaigns Tax Deductible?

(Don’t mind the Cubs Profile Picture)

What do you know, Twitter is all about politics right now. The simple answer to this…NO. While you are free to donate your money to a political movement that you believe in, it will not benefit you on your tax return. In order to be tax deductible, contributions must be made to a qualified charitable organization. If you are unsure if the organization qualifies, ask them, or use this IRS Tool.

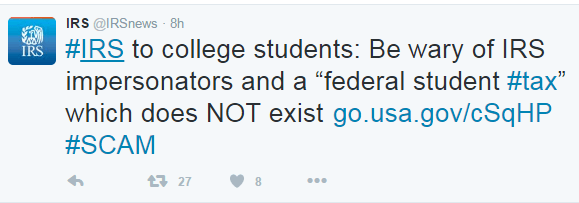

Federal Student Tax Scam

The Internal Revenue Service issued a warning to taxpayers about bogus phone calls from IRS impersonators demanding payment for a non-existent tax, the “Federal Student Tax.”

Even though the tax deadline has come and gone, scammers continue to use varied strategies to trick people, in this case students. In this newest twist, they try to convince people to wire money immediately to the scammer. If the victim does not fall quickly enough for this fake “federal student tax”, the scammer threatens to report the student to the police.

“These scams and schemes continue to evolve nationwide, and now they’re trying to trick students,” said IRS Commissioner John Koskinen. “Taxpayers should remain vigilant and not fall prey to these aggressive calls demanding immediate payment of a tax supposedly owed.”

This is just another tactic being used by scammers. We have probably all heard of or received of these phone calls, this is just a different target towards college students. REMEMBER: The IRS will never call or e-mail you.

Complaints About Olympic Athletes Taxed On Medals

As I mentioned in an earlier post, Olympic athletes are taxed on both their winnings AND the value of the medal that they receive. There is much banter on Twitter from people complaining that the IRS needs to change this rule. However, it is important to remember that the IRS does not make the tax law….Congress does!

By the way Ryan Lochte & Co. will not be able to deduct their legal expenses for their debacle against their earnings

Twitter is the first place I go to for updated news. It has become the first source that reporters go to…it is instant news. I enjoyed seeing what people were talking about regarding the word “tax”, I think I may have to do this more often!

Until next time,

Nicholas Hammernik, EA

The post Twitter Tax Search appeared first on Talking Tax to Milwaukee.

See More Blog Posts